Videos From Our Fall Programs: Inflation Reduction Act & Medicare

/Below you’ll find the two videos of the programs, with short descriptions, plus some useful links from the first program.

Local Vision and Implication of the Inflation Reduction Act.

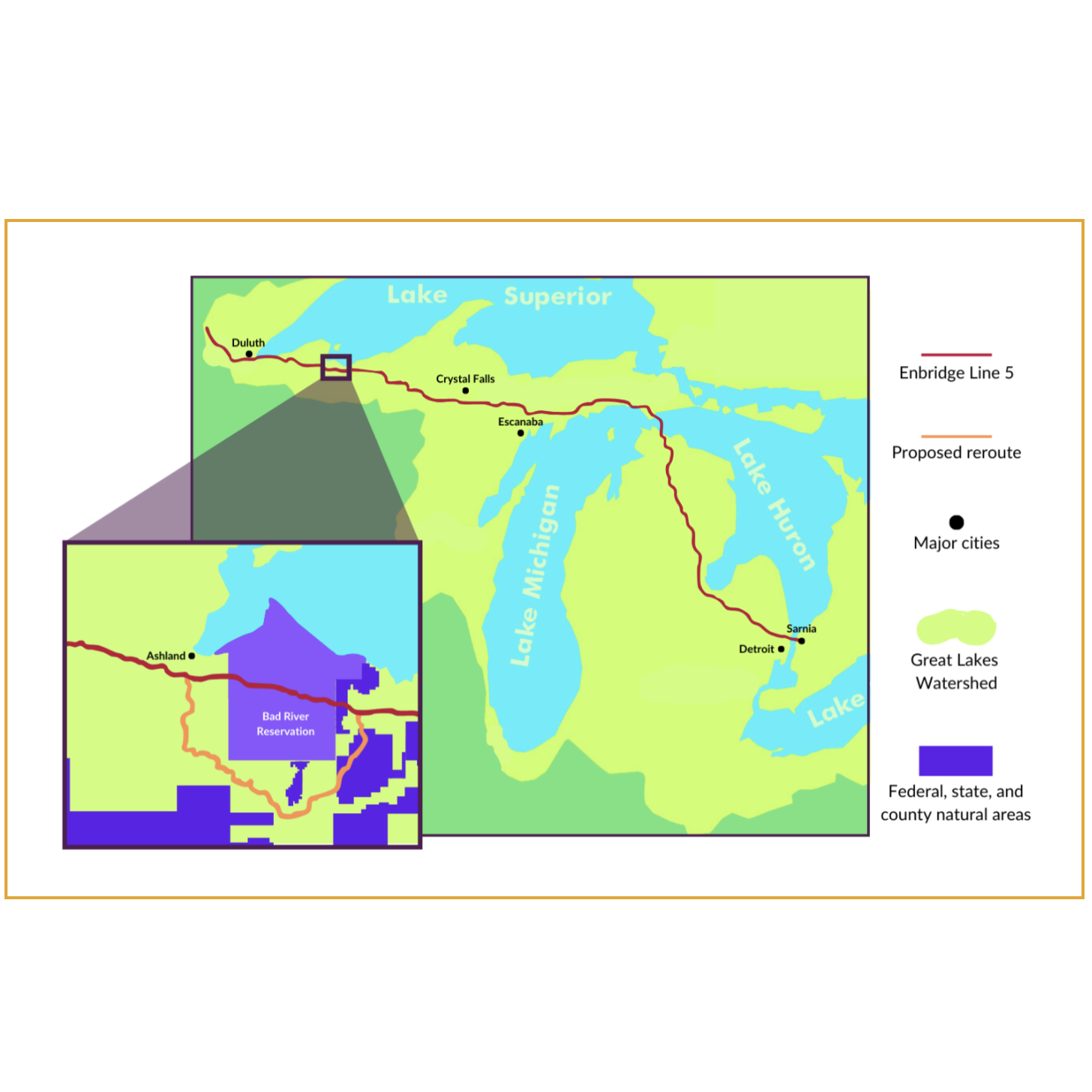

This landmark federal Act (IRA) addresses some primary topics: Medicare, Transition to Sustainable Energy/Climate Chaos Action, and some taxation loophole changes. It is a complex piece of legislation. We have invited Ashland/Bayfield County and Bad River representatives as well as leaders from the local Utility and Health Sectors to serve on a panel. They will help interpret the IRA and address the local vision of how this will impact our community and our citizens. There will be ample time for participant questions

and comments.

Addendum—Inflation Reduction Act: References on Taxation and Medicare Elements

Two significant elements of the Inflation Reduction Act (IRA) in addition to that of Clean Energy/Climate Action are Taxation and Medicare. As the IRA is a very recent and complex piece of federal legislation, details remain in the process of being spelled out.

Agencies such in Health Care and Financial agencies in Washington are preparing language and guidelines to implement the IRA. The following offers a bit of what the public has been provided thus far.

Taxation: IRA offers provision to enhance customer service and IRS capacity, closes loopholes in the tax codes for corporations while providing more equitable taxing for small businesses, details energy related tax credits.

Medicare: IRA includes elements that secure the integrity of the Medicare system as well as reduce the costs of health care for Seniors. Changes will occur over time.

Allows Medicare to negotiate the price of drugs beginning with medications for diabetes, cancer and most costly drugs and moving forward over time

Limits the cost to insulin to $35

Penalizes drug makers for raising prices higher then inflation

Caps our of pocket yearly costs for individuals on Medicare Part D to $2000

Makes most vaccines available at no costs

Useful References:

https://www.washingtonpost.com/business/2022/08/16/inflation-reduction-act-save-money/

Medicare and the Threats to Health Security for Seniors/Privatization of Medicare

Ours is an aging population, as is true of many rural counties in WI. This program will focus on Medicare and the “Threats to Health Security for Seniors/Privatization of Medicare." As citizens reach 65 and each subsequent October through December, we are inundated with emails, phone calls, TV/Media advertisement and mailings urging us to switch away from traditional Medicare-the program that brought tears of relief to our grandparents and closed down the County Poor Farms. The advertising is confusing and is not without consequences both for individuals but also to the solvency of Medicare itself. The evening will begin with speakers from the Health Care Access team of Wisconsin Citizen Action with a panel of local health experts responding and ending with participants' questions/comments.