Monday, September 26

Fall Membership/Friends/Recruitment Meeting

6pm–8pm

Vaughn Library Second Floor Meeting Room

or via Zoom

This will be a hybrid meeting with in-person participation and a virtual option. Those who feel able can join us. We will be utilizing our newly acquired OWL virtual meeting technology.

Those wishing to join virtually can simply click the invite link: https://us02web.zoom.us/j/83343102826?pwd=Tk41aFNrT2YrZ0IwcDBxVnB4OUdyQT09

Meeting ID: 833 4310 2826

Passcode: 217027

Dial by your location: +1 312 626 6799

Please bring friends to the Vaughn Library or share the link. Everyone is invited to have dessert, be that a great fall apple or a pumpkin bar, either at their home laptop or bringing a treat to share in person.

Program: Local Vision and Implication of the Inflation Reduction Act.

The focus of this program will be “Local Vision and Implication of the Inflation Reduction Act.” This landmark federal Act (IRA) addresses some primary topics:

Medicare

Transition to Sustainable Energy/Climate Chaos Action

Some taxation loophole changes.

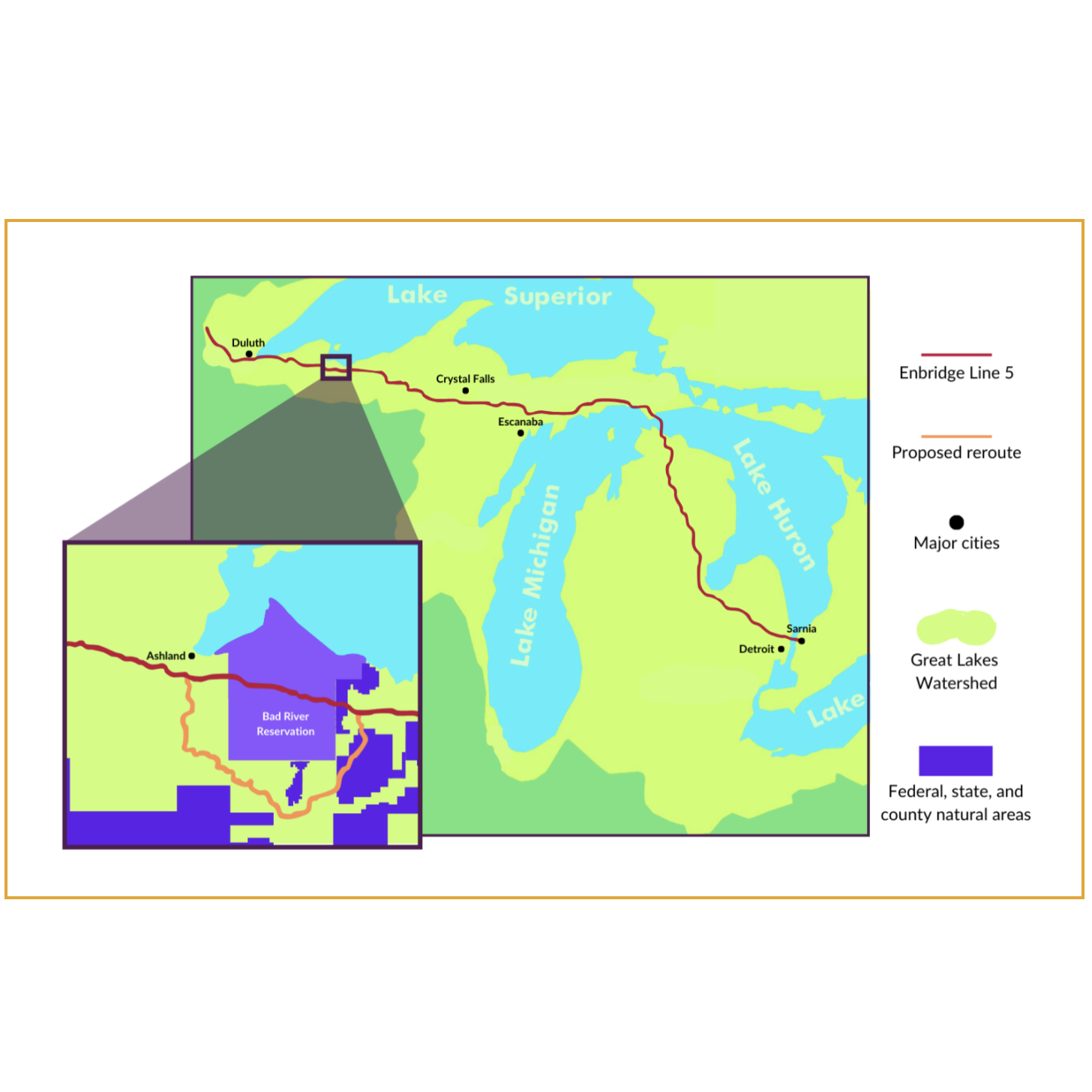

It is a complex piece of legislation. We have invited Ashland/Bayfield County and Bad River representatives as well as leaders from the local Utility and Health Sectors to serve on a panel. They will help interpret the IRA and address the local vision of how this will impact our community and our citizens. There will be ample time for participant questions and comments.

Addendum—Inflation Reduction Act: References on Taxation and Medicare Elements

Two significant elements of the Inflation Reduction Act (IRA) in addition to that of Clean Energy/Climate Action are Taxation and Medicare. As the IRA is a very recent and complex piece of federal legislation, details remain in the process of being spelled out.

Agencies such in Health Care and Financial agencies in Washington are preparing language and guidelines to implement the IRA. The following offers a bit of what the public has been provided thus far.

Taxation: IRA offers provision to enhance customer service and IRS capacity, closes loopholes in the tax codes for corporations while providing more equitable taxing for small businesses, details energy related tax credits.

Medicare: IRA includes elements that secure the integrity of the Medicare system as well as reduce the costs of health care for Seniors. Changes will occur over time.

Allows Medicare to negotiate the price of drugs beginning with medications for diabetes, cancer and most costly drugs and moving forward over time

Limits the cost to insulin to $35

Penalizes drug makers for raising prices higher then inflation

Caps our of pocket yearly costs for individuals on Medicare Part D to $2000

Makes most vaccines available at no costs

Useful References:

https://www.washingtonpost.com/business/2022/08/16/inflation-reduction-act-save-money/